That spare bedroom or converted garage could be your ticket to hundreds or even thousands in tax savings—but only if you follow the IRS rules precisely. If you’re self-employed and work from home, understanding how to write off home office expenses properly separates those who maximize their deductions from those who leave money on the table or trigger an audit. This guide cuts through the confusion to show you exactly how to claim this valuable deduction while staying fully compliant with current IRS regulations.

Most self-employed professionals miss out on legitimate home office write-offs because they believe common myths like “only homeowners can claim it” or “you need a separate building.” The truth? Whether you’re a freelance graphic designer in a studio apartment or a consultant working from a suburban home, you likely qualify for this deduction if you meet two critical tests. In the next few minutes, you’ll discover how to calculate your deduction using both IRS methods, document your space properly, and avoid the top mistakes that trigger IRS scrutiny—potentially saving you hundreds on your next tax bill.

Qualify as Self-Employed for Home Office Deductions

Confirm Your Eligible Tax Status

You can write off home office expenses if you report business income on Schedule C (Form 1040) as a freelancer, independent contractor, sole proprietor, or single-member LLC. This applies equally whether you own or rent your home—tenants get identical treatment to homeowners under current IRS rules. Even if you have a full-time W-2 job but run a side business, you qualify for the business-use portion of your home.

Critical distinction: W-2 employees cannot claim home office deductions through 2025 due to the Tax Cuts and Jobs Act suspension of miscellaneous itemized deductions. This restriction expires after 2025 unless Congress extends it. S-Corporation owners must route home office costs through an accountable plan or rent the space to their corporation—they can’t use the direct Form 8829 approach available to Schedule C filers.

Identify Disqualifying Situations

Your business structure determines your eligibility. Partners in partnerships may qualify, but the deduction flows through to individual returns via Schedule K-1, making it outside the Schedule C scope covered here. Multiple businesses sharing the same office space create complications—the exclusive-use test becomes nearly impossible to satisfy unless you implement IRS-approved time-sharing (which rarely passes muster).

Red flag alert: If your “office” is a dining room table that converts back to family use each evening, you’ve failed the exclusive-use test. The IRS specifically disallows spaces that serve dual purposes, no matter how convenient this seems in small living situations.

Pass the IRS’s Exclusive and Regular Use Tests

Maintain Strict Business-Only Space

Your home office must be used exclusively for business—no exceptions for “just checking personal email” or storing holiday decorations. This means dedicated space that serves no personal function whatsoever. A converted garage, basement room, or partitioned section of your living area qualifies if you maintain clear boundaries.

Valid exceptions exist for state-licensed day-care facilities or inventory storage when your home is your business’s only fixed location. In these cases, the IRS relaxes the exclusive-use requirement, but you must document your compliance with state licensing or maintain detailed inventory logs.

Prove Your Principal Place of Business

Your home office must serve as your principal place of business or the sole location where you meet clients. The good news? If you handle administrative tasks like billing, scheduling, and record-keeping at home with no other fixed location for these activities, you satisfy this requirement—even if you deliver services elsewhere.

Pro tip: Detached structures like garages, studios, or sheds automatically qualify when used exclusively and regularly for business, regardless of whether they serve as your principal place of business. This makes converted outbuildings particularly valuable for deduction purposes.

Calculate Your Precise Business Use Percentage

Square Footage Method for Accuracy

Measure your office’s exact square footage and divide by your home’s total finished square footage. A 150 sq ft office in a 1,800 sq ft home equals 8.3% business use. This method requires precise measurements but typically yields the most accurate deduction.

Documentation essential: Create a simple floor-plan sketch showing your office dimensions and total home square footage. Store this with your tax records—it’s the first document auditors will request.

Rooms Method for Simplicity

If all rooms in your home are roughly similar size, use the ratio of business rooms to total rooms. One dedicated office in a seven-room house equals 14.3% business use. The IRS accepts this approach when square footage measurements would be impractical.

Consistency rule: Whichever method you choose, maintain it consistently year after year. Switching methods requires justification and increases audit risk. Document your calculation method annually to demonstrate reasonable consistency.

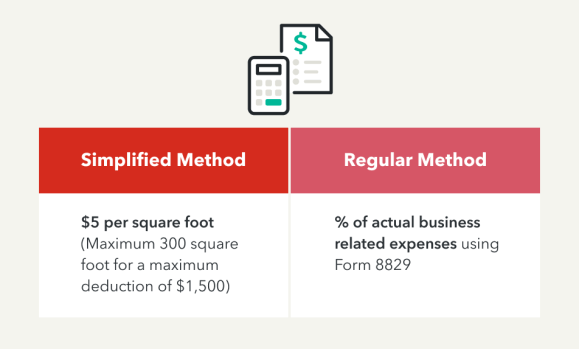

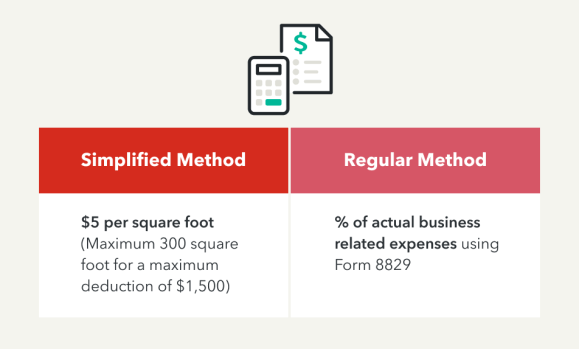

Choose Between Simplified and Actual Expense Methods

Simplified Method: Claim $5 Per Square Foot

Multiply your office square footage by $5, capped at 300 square feet ($1,500 maximum deduction). Claim this directly on Schedule C, Line 30 with no additional forms required. This method requires minimal record-keeping—just verify your space measurements.

Best for: Spaces under 300 sq ft, those with lower actual expenses, or taxpayers prioritizing simplicity over maximum deductions. Ideal if you plan to sell your home soon to avoid depreciation recapture complications.

Actual Expense Method: Maximize Your Deduction

Calculate actual costs multiplied by your business-use percentage. This includes mortgage interest, real estate taxes, rent, utilities, insurance, repairs, and depreciation. Requires Form 8829 plus Schedule C and detailed receipts for every expense.

When it wins: If your actual expenses exceed $1,500 significantly, the actual method usually produces larger deductions—unless you plan to sell your home within a few years (depreciation recapture applies at 25% tax rate).

Track Every Deductible Home Office Expense

Direct Expenses You Can Fully Deduct

- Office-specific repairs like repainting walls or replacing flooring

- Furniture and equipment used exclusively for business

- Dedicated phone lines or internet circuits installed solely for office use

Smart documentation: Take dated photos showing these business-only elements. This visual proof becomes crucial if auditors question your exclusive use claim.

Indirect Expenses Calculated by Business Percentage

- Mortgage interest (non-itemized portion)

- Real estate taxes (non-itemized portion)

- Rent payments

- Utilities: electricity, gas, water, heating, trash

- Homeowner’s or renter’s insurance

- Whole-house repairs and maintenance

- Security system monitoring

- HOA fees

Critical warning: Never double-dip—mortgage interest and property taxes claimed for business cannot also be itemized on Schedule A. Coordinate these deductions carefully to avoid audit triggers.

Avoid Depreciation Recapture Traps

Homeowner Depreciation Requirements

If you own your home and use the actual-expense method, you must depreciate the business portion using the lesser of your adjusted basis or fair market value when you started using the office. Remember: only the building portion qualifies—land value must be excluded from calculations.

Example: A $350,000 home on $100,000 land has $250,000 depreciable basis. At 10% business use, $25,000 becomes your depreciable amount.

Recapture Rules When Selling Your Home

Depreciation claimed after May 6, 1997 gets “recaptured” and taxed at up to 25% when you sell your home. This applies even if you didn’t claim depreciation—you’ll owe tax on “allowable” depreciation.

Strategic move: Using the simplified method for all years avoids depreciation recapture entirely. If you plan to sell within 5 years, this often outweighs the slightly higher annual deduction from the actual method.

File Forms Correctly to Prevent Audit Flags

Simplified Method Paperwork

Claim directly on Schedule C, Line 30. No additional forms required. Simply enter your calculated deduction (sq ft × $5, max $1,500). This method’s simplicity significantly reduces audit risk.

Time investment: Less than 15 minutes annually—ideal for solopreneurs with limited tax expertise.

Actual Method Filing Requirements

- Form 8829: Calculate business-use percentage, allocate expenses, compute depreciation

- Schedule C: Line 30 pulls from Form 8829

- Form 4562: Handle depreciation of office-specific assets (computers, furniture)

Common error: Failing to coordinate mortgage interest and property taxes between business and personal deductions. Double-check that amounts claimed on Form 8829 don’t overlap with Schedule A itemized deductions.

Maintain Audit-Proof Documentation

Essential Records to Keep

- Floor-plan sketch with square-footage calculations

- Digital copies of all receipts (keep 3 years minimum, 6 years for substantial deductions)

- Dated photos proving exclusive business use

- Client meeting logs or time-tracking records

- Business license copies if claiming day-care exception

Pro tip: Organize digital records in dated folders by tax year. Cloud storage protects against physical damage while providing instant access during audits.

Record-Keeping Timeline

Keep documentation for 3 years after filing your return (6 years if you underreported income by more than 25%). Store digital copies to prevent fading or damage—IRS accepts electronic records as valid documentation.

Audit reality check: Home office deductions trigger scrutiny when claimed without supporting documentation. The time you invest in organization now prevents costly professional fees later.

Maximize Your Home Office Tax Strategy

The home office deduction remains one of the most valuable tax breaks for self-employed professionals, potentially saving hundreds annually. Your success depends on proper documentation, accurate calculations, and strategic method selection each year—you can switch between simplified and actual methods without penalty.

Immediate action: Measure your office space today and begin collecting receipts, even if using the simplified method. Build documentation habits now to support future claims. If you have complex situations like multiple businesses or significant home improvements, consult a tax professional before filing—this small investment often pays for itself in optimized deductions and audit protection.

Remember: The IRS isn’t looking to deny legitimate claims—they’re targeting sloppy record-keeping and obvious rule violations. By following these precise steps, you transform that home workspace from a business necessity into legitimate tax savings, putting more money in your pocket where it belongs.