You’ve seen the HGTV transformations where dated houses become dream homes in 30 minutes. But when you learn how to flip a home successfully, reality hits hard: one blown budget or delayed permit can erase your profit overnight. Real house flipping demands 120 days of relentless execution, not reality TV glamour. The math is brutal—20-25% returns are achievable, but only if you nail every phase from acquisition to closing. This guide reveals the exact framework top flippers use to avoid six-figure mistakes and pocket consistent profits.

Target the Exact Properties That Guarantee Profit

Avoid These Deal-Killing Red Flags Immediately

Skip houses with foundation cracks wider than ¼ inch, roofs older than 15 years, or galvanized plumbing—these trigger $15,000+ repairs that destroy margins. Your profit blueprint requires properties built after 1960 needing only cosmetic updates. Focus exclusively on 1,200-2,500 sq ft homes with three bedrooms and two bathrooms; this sweet spot attracts the broadest buyer pool and sells fastest. When you analyze a potential flip, verify electrical panels exceed 100 amps—anything less requires $5,000 upgrades before you touch a paintbrush.

Your 70% Profit Formula Must Be Non-Negotiable:

Purchase price = (70% of After Repair Value) – Renovation Costs

Example: On a $300,000 ARV home needing $40,000 updates, max purchase price = $170,000

Source Off-Market Deals Before Competitors See Them

Drive 100-200 distressed properties weekly in target neighborhoods—this “driving for dollars” tactic yields hidden gems MLS listings miss. Send 500 postcards weekly to high-equity homeowners; expect 10-15 responses with one viable deal monthly. When estate sales pop up, move fast: emotional sellers often accept 10-15% below market for quick closings. Critical move: Contact 3-5 wholesalers every Monday—they control 30% of profitable flips but demand speed. Review foreclosure auction lists every Thursday; these require 10% cash down but sell dirt cheap when others fear the process.

Master the Flip Profit Calculator Before Writing an Offer

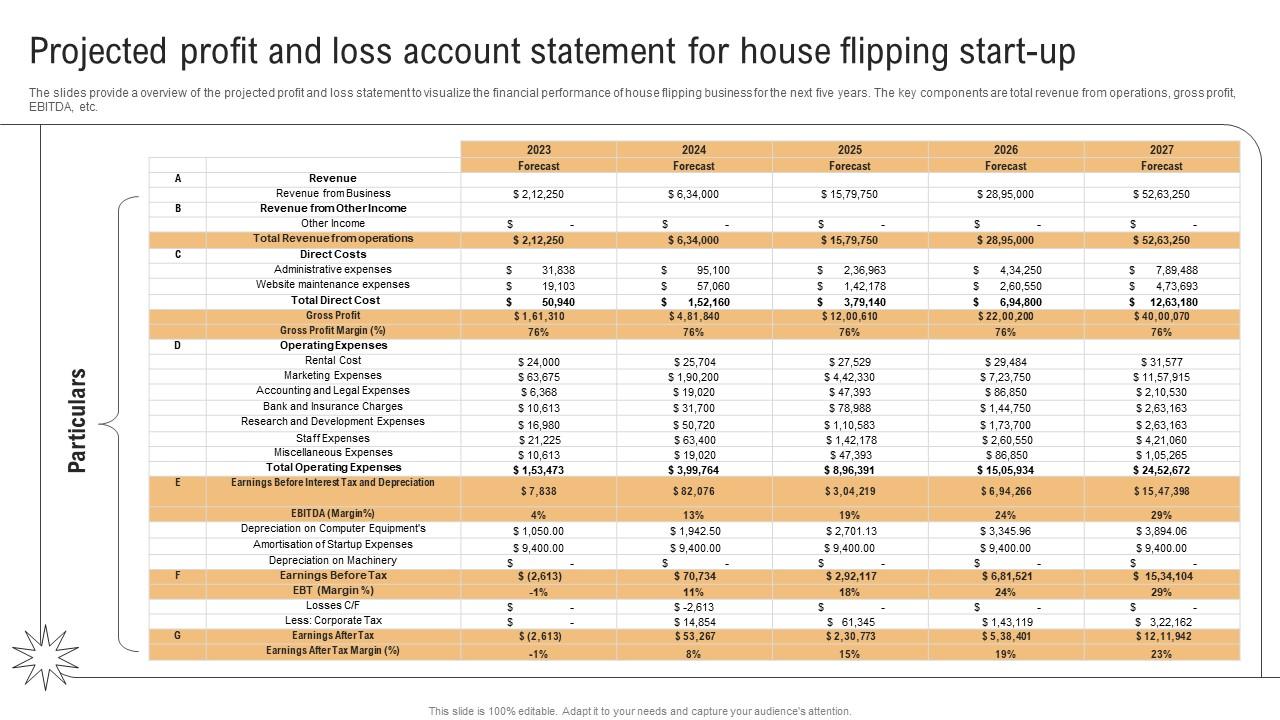

Lock Down Your Minimum Capital Requirements

You need 20-25% down for purchase, plus 20% of purchase price for renovations, six months of carrying costs (mortgage/taxes/insurance), and 3-5% for closing fees. On a $200,000 property, that’s $90,000 cash before you touch a tool. Never skip this math: Gross Profit = Sale Price – Purchase Price – All Expenses. Target 20-25% margins minimum—anything less risks your business. If your numbers show under $40,000 profit on a $200,000 investment, walk away immediately.

Track Expenses Like Your Business Depends on It (Because It Does)

Categorize every dollar: Acquisition (title/inspection fees), Renovation (materials/labor), Carrying (mortgage/utilities), and Selling (commissions/staging). Use QuickBooks to monitor these KPIs religiously:

– Days in inventory under 120 days

– Cost overruns under 10% of budget

– ROI exceeding 15% per flip

Pro tip: Build a 10-15% contingency into your budget—renovation surprises will hit, and unprepared flippers eat those costs.

Finance Your Flip Without Losing Half Your Profit to Interest

Choose Hard Money Only When Speed Trumps Cost

Hard money loans charge 12-18% interest and 2-5 points upfront but close in 7-14 days—essential when competing for off-market deals. Only use them if you have 600+ credit and can exit in under six months. Never take hard money for “fixer-uppers” needing major structural work—the interest will devour your margin. For conventional investment loans (680+ credit, 20-25% down), expect 30-45 day closes but pay just 1-2% above owner-occupied rates.

Tap Private Money for 8-15% Interest Rates

Friends, family, or self-directed IRA investors offer negotiable terms with one non-negotiable: document everything with promissory notes and deeds of trust. This funding source saves $10,000+ in interest versus hard money on a $150,000 loan. Critical warning: Never mix personal relationships with business—get a real estate attorney to draft all paperwork.

Renovate for ROI: Where Every Dollar Must Earn Its Keep

Allocate Your Budget Like a Profit Machine

Kitchen: 15-20% of renovation budget (reface cabinets for $3,000 vs. $12,000 replacement)

Bathrooms: 10-15% per bathroom (tile surrounds at $8-20/sq ft)

Flooring: 8-12% (LVP at $3-7/sq ft installed)

Paint: 3-5% (interior/exterior)

Non-negotiable: Hold 10-15% for contingency—material shortages and weather delays will hit.

Execute High-Impact Updates That Sell Houses

Kitchen renovations deliver 80-100% ROI: install $40-80/sq ft granite counters and $3,000-8,000 stainless appliance packages. Bathrooms yield 70-80% ROI—replace vanities ($300-1,500) and upgrade fixtures ($200-800). Avoid this mistake: Over-improving for the neighborhood. In a $300,000 area, skip $20,000 smart toilets—buyers won’t pay for them.

Manage Contractors to Prevent Budget Blowouts

Vet Like Your Profit Depends on It (Because It Does)

Demand three references from recent flips, current licenses/insurance, and BBB ratings. Require detailed written estimates showing line-item costs—not hourly bids. Critical step: Verify their bonding status—unbonded contractors leave you liable for $50,000+ in unpaid subcontractor bills. Never pay more than 10% upfront, hold 10% retention until final walkthrough, and collect lien waivers at every payment.

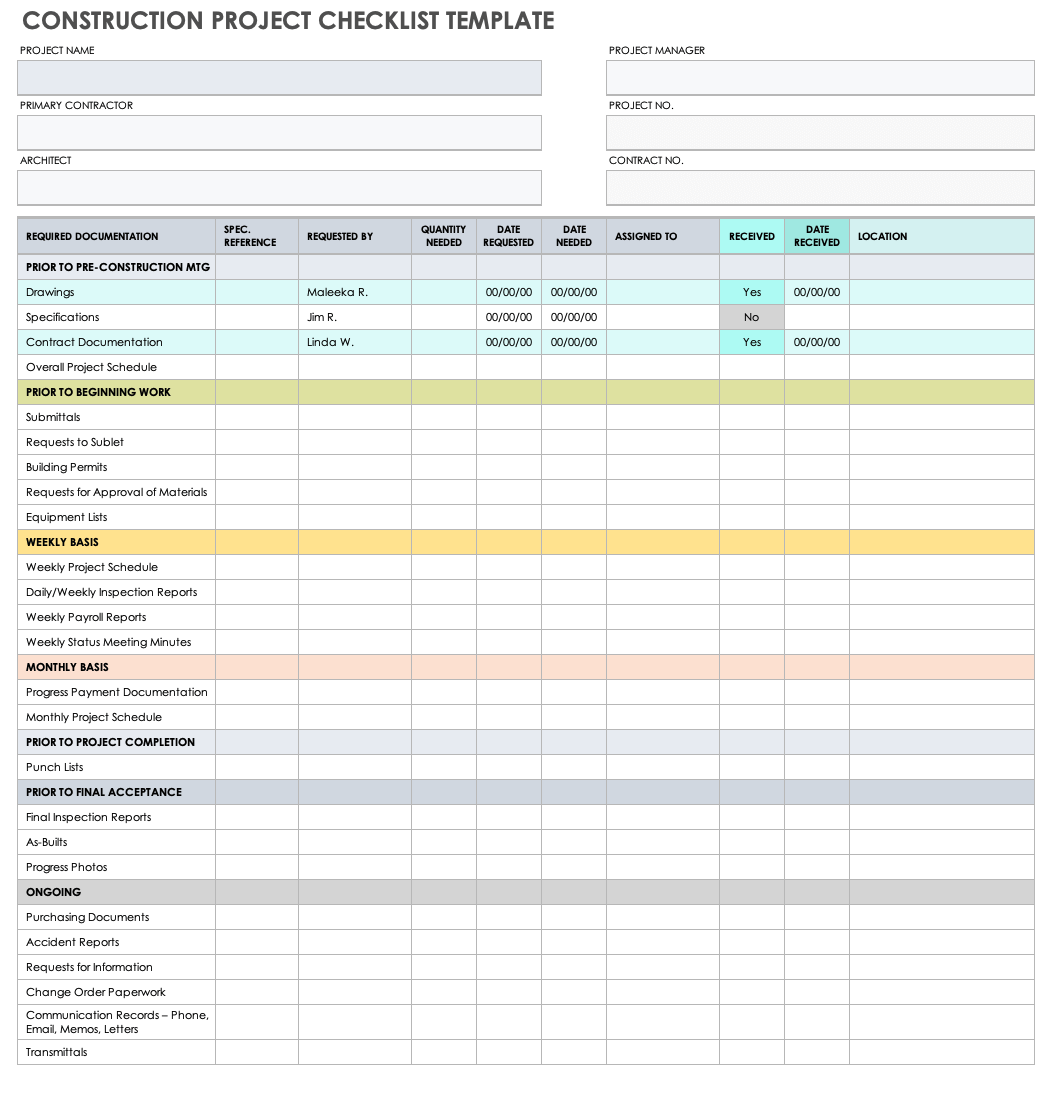

Implement Military-Grade Project Tracking

Hold Friday progress meetings where contractors show photo documentation from the past 48 hours. Track percentage complete versus budget spent—if Week 6 shows 70% work done but 85% budget spent, stop everything. Require written approval for change orders; scope creep destroys 68% of flip profits. Pro tip: Use Buildertrend software to flag delays before they cost you $1,000/day in carrying costs.

Execute the 90-Day Flip Timeline Without Delays

.webp)

Follow This Week-by-Week Critical Path

Weeks 1-2: Secure permits—this is where 73% of flips fall behind. Pull electrical rough-in permits before insulation goes up.

Weeks 3-6: Complete HVAC/plumbing/electrical—never let drywall hide unfinished inspections.

Weeks 5-8: Hit kitchens/bathrooms; order custom cabinets at Week 3 (4-8 week lead time).

Weeks 9-11: Final landscaping—$2,000 spent here generates $4,000+ in perceived value.

Week 12: Stage professionally; homes sell 73% faster with $1,500-4,000 staging investments.

Material Warning: Countertops need templating at Week 7 for Week 9 installation—if you delay, your timeline implodes. Track every lead time like your profit depends on it (because it does).

Sell Fast With Pricing and Staging Tactics That Work

Price Using the 90-Day Comp Method

Identify three exact comps sold within 90 days, adjust for square footage ($50-150/sq ft), then price 2-5% below market. Never test full price for over two weeks—if no offers by Day 14, drop 2-3%. After Day 21, slash another 2-3%; holding costs eat $100/day in a $250,000 flip.

Stage Like You’re Selling Your Own Retirement

Declutter completely and paint everything neutral beige or gray—bold colors cost you buyers. Invest $500 in strategic lighting; warm bulbs make spaces feel 30% larger. Non-negotiable: Fix curb appeal first—$500 in fresh mulch and flowers makes buyers forgive interior flaws. Hire a pro photographer for twilight shots; listings with these sell 17% faster.

Protect Profits With These Risk Shields

Avoid the Two Deal-Killers 92% of New Flippers Ignore

Market risk: Never over-improve—a $50,000 kitchen in a $300,000 neighborhood won’t recoup costs. Maintain a 20% profit buffer in projections. Contractor risk: Always have three backup contractors per trade—when your electrician vanishes at Week 4 (and they will), you save $8,000 in delay costs.

Activate Your Contingency Plan Before Disaster Strikes

If the market slows, refinance to a rental immediately if Debt Service Coverage Ratio exceeds 1.2x. For cost overruns, value-engineer materials (choose quartz instead of marble) rather than cutting scope. Critical rule: Never pay overtime to “catch up”—extending timeline by two weeks costs less than 15% budget blowouts.

Your flip starts now—not when you find a property. Drive target neighborhoods today, analyze three deals using the 70% formula, and build your contractor list. Profitable house flipping isn’t about luck; it’s about executing a proven system while avoiding emotional decisions. Master these steps, track every metric, and your next flip won’t just be another house—it’ll be your most profitable investment yet. The difference between flippers who thrive and those who fail comes down to one question: Did you follow the system, or did you improvise?