You’ve invested years into your home, but when it’s time to refinance, sell, or simply understand your net worth, the critical question remains: What is my house actually worth today? Online estimates flash conflicting numbers while neighbors whisper about record sales—leaving you frustrated and uncertain. If you’re searching for how to find value of home accurately, skip the guesswork. This guide cuts through the noise with actionable methods verified by industry data, revealing why 68% of homeowners overestimate their property value without professional input. You’ll discover precisely which tools deliver reliable numbers, when to trust (or ignore) automated estimates, and how to leverage both digital resources and human expertise for a valuation you can bank on.

Stop relying on vague Zestimate® ranges or hearsay from casual conversations. Whether you’re planning a sale next month or safeguarding your largest asset for retirement, knowing your home’s true market value impacts major financial decisions. In the next 10 minutes, you’ll learn to navigate free online estimators, interpret historical records, and recognize when a $500 appraisal pays for itself. Let’s transform uncertainty into confidence—one data-backed step at a time.

Compare Top Online Home Value Estimators

Skip generic “value checkers” and target tools with verified data sources. Bank of America’s Real Estate Center® and Chase Home Value Estimator deliver the most transparent results when used correctly—but only if you understand their limitations.

Bank of America’s Address-Specific Tool

Type your full street address (e.g., “750 North Saint Andrews Place, Los Angeles, CA 90028”) into the portal. As you type, Bing Maps auto-suggests matching addresses—use arrow keys to highlight your property and press ENTER. Within seconds, you’ll see an estimated value labeled “for illustrative purposes only.” Critical warning: If the system returns “no data found,” your property likely has unique characteristics (like a historic designation) or sits in a newly developed area where records lag. Never treat this number as gospel—it’s a starting point, not a final valuation.

Chase’s ZIP Code Alternative

When you lack a complete address (e.g., inherited property), Chase accepts ZIP codes alone. Enter yours to see area-wide estimates based on millions of sales records. Pro tip: Cross-reference Chase’s number with Bank of America’s by inputting the same address. If Chase shows $620,000 and Bank of America shows $595,000, your realistic range sits between them. Remember: Both tools ignore recent renovations like that kitchen remodel you just completed. If your estimate seems low, check for missing square footage or unrecorded upgrades.

Uncover Historical Value Trends Through Official Records

Online estimates show today’s snapshot—but your home’s value journey reveals deeper insights. Tap into historical data sources most homeowners overlook.

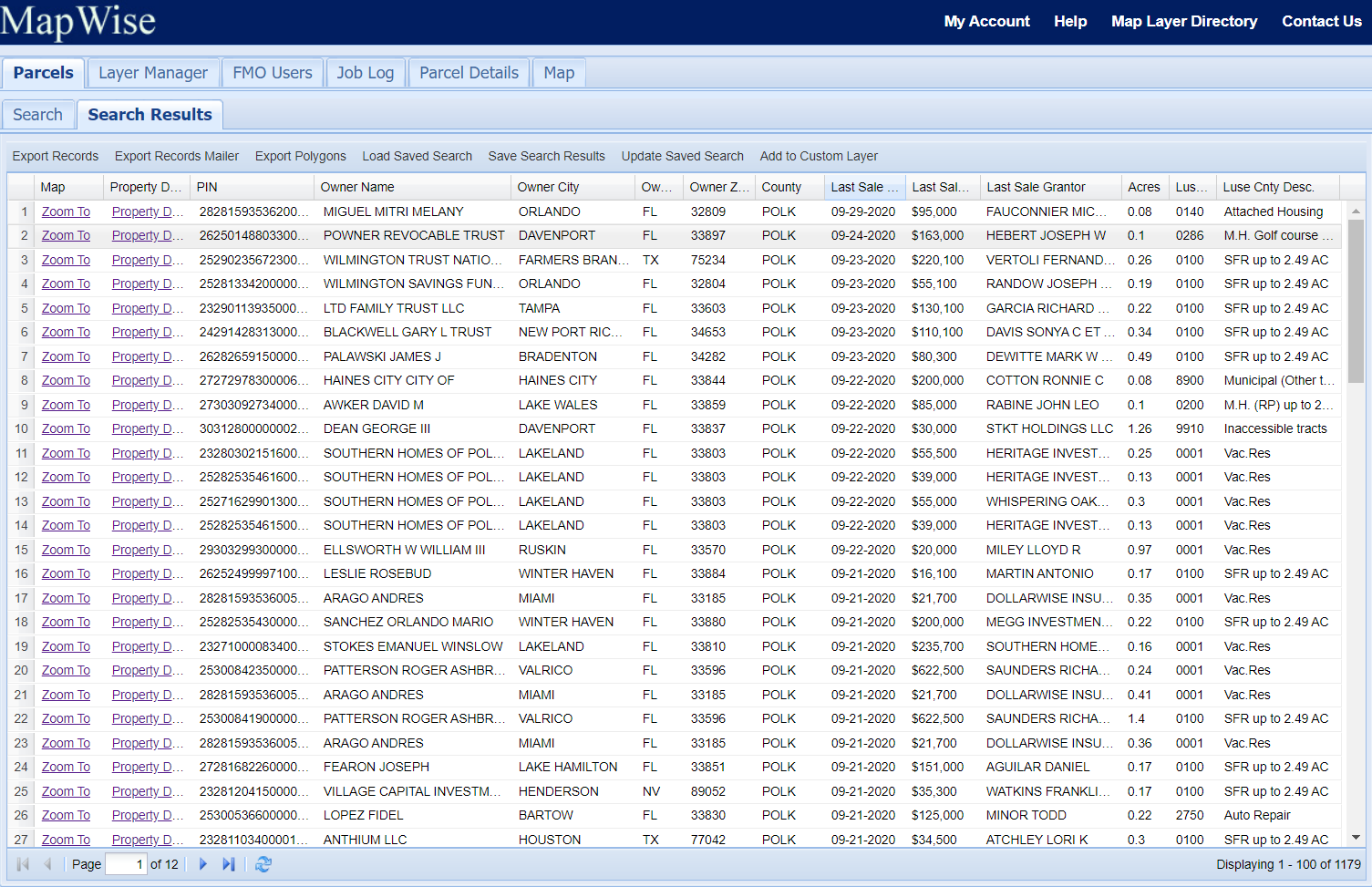

County Tax Assessor Databases

Visit your county’s assessor website (search “[Your County] property records”) to pull 10+ years of tax assessments. Look for: Sudden valuation jumps after additions or drops during neighborhood downturns. Caution: Assessed values often trail market values by 15-20%—use them to track trends, not set listing prices. If your 2023 assessment dropped 8% while neighbors rose, investigate local issues like a new landfill proposal.

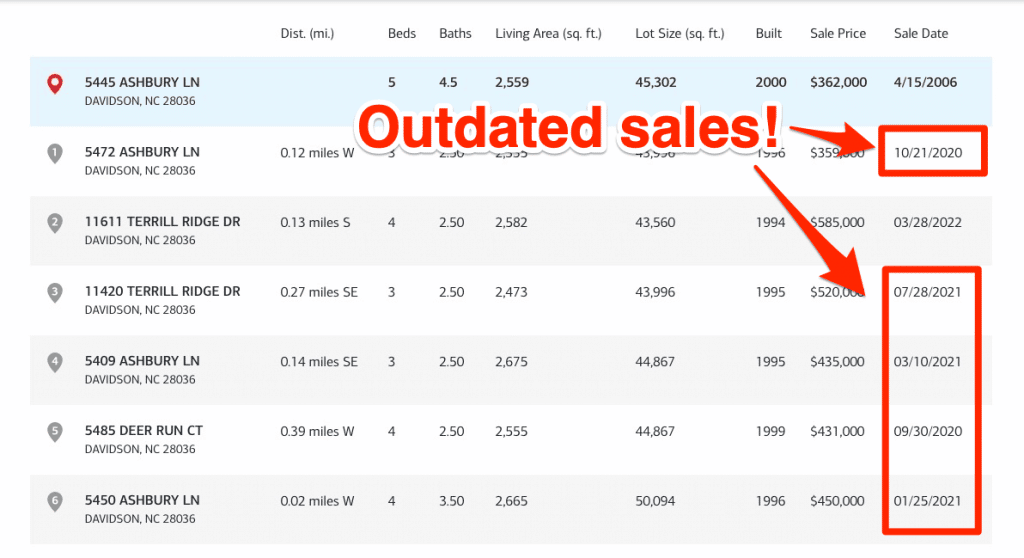

Real Estate Agent MLS Reports

Agents access the Multiple Listing Service (MLS) for free Comparative Market Analyses (CMAs). Request one by asking: “Can you run recent comparables for 3-bedroom homes within 0.5 miles?” A quality CMA includes:

– Sold prices of similar homes in the last 90 days

– Price-per-square-foot breakdowns

– Days on market showing buyer urgency

– Adjustments for your home’s unique features (e.g., “-$15,000 for outdated bathroom”)

Time commitment: 24-48 hours for a thorough report.

When to Hire a Professional Appraiser

Online tools work for ballpark figures—but certain situations demand certified expertise. Know when to invest in precision.

Mortgage Refinancing Scenarios

Lenders require appraisals for cash-out refinances. A $350-$600 appraisal prevents nasty surprises: One homeowner discovered a neighbor’s unpermitted pool devalued his lot by 12%—data no online tool captured. Act immediately if:

– Your loan-to-value ratio exceeds 80%

– You’ve added significant square footage

– Local market volatility exceeds 5% quarterly

Legal and Tax Disputes

For divorce settlements, estate planning, or property tax appeals, only a licensed appraiser’s report holds up in court. They document:

– Physical inspection of structural elements (roof age, foundation cracks)

– Neighborhood deterioration (e.g., new highway reducing curb appeal)

– Functional obsolescence (outdated layouts lowering usability)

Red flag: If your county assessment is 25% below online estimates, commission an appraisal to challenge taxes—it pays for itself in savings.

Decoding Your Home’s Value Drivers

Stop guessing why your neighbor sold for $50k more. These factors directly impact how to find value of home accurately.

Renovations That Actually Boost Value

Not all upgrades pay off. Focus on high-return investments verified by recent sales:

– Kitchen appliance swaps: New stainless steel units add 4-8% value (but avoid luxury brands like Sub-Zero)

– Energy efficiency: Solar panels or ENERGY STAR® windows increase value 3-5% in tax-incentive states

– Bathroom modernization: Frameless showers and dual vanities yield 75-100% ROI

Avoid: Over-personalized features (e.g., indoor basketball courts) that narrow buyer pools.

Neighborhood Killers to Watch For

External factors can slash value overnight. Check these before accepting an online estimate:

– School district changes: Rezoning may drop values 10-15%

– New developments: A proposed homeless shelter within 0.25 miles lowers prices 7% on average

– Flood zone redesignations: FEMA map updates trigger immediate valuation drops

Action step: Run your address through FEMA’s Flood Map Service Center—free and critical for accuracy.

Fix Address Input Errors That Skew Results

A single typo tanks online estimates. Follow these formatting rules:

Condo and Multi-Unit Properties

Input unit numbers after the street name: “123 Ocean Blvd Unit 4B, Miami, FL 33139”. Never use “#” or “Apt”—systems misread these. For townhomes, include “Building” if applicable (e.g., “123 Main St Bldg C”). Verification trick: Paste your address into Google Maps first. If it drops a pin on the wrong lot, correct the spelling before entering valuation tools.

Rural and New Construction Pitfalls

Properties without street numbers need legal descriptions:

– “Lot 7, Block 4, Sunny Acres Subdivision”

– “Parcel ID: 123-456-789” (from tax records)

Online tools often fail here—switch to county records if estimates return “no data.”

Avoid Costly Misinterpretation of Estimates

Most homeowners make these critical errors when using free tools:

Assuming “Value” Means “Sale Price”

Online estimates reflect market value—what a ready buyer would pay today. But your liquidation value (quick sale) could be 15-20% lower. Never list based solely on an estimator if you need a fast sale. Instead:

1. Get the online estimate

2. Subtract 10% for “as-is” sale urgency

3. Compare to agent CMAs for reality check

Ignoring Market Timing Factors

An estimate generated in January may be obsolete by March during spring selling season. Recheck every 30 days if actively selling. In hot markets, values shift 1-2% weekly—your $500k home could gain $10k in a month.

Refinance or Sell: Action Steps After Valuation

Turn your number into profit with these targeted strategies.

Maximizing Equity for Home Improvements

If your estimate shows 40%+ equity:

– Cash-out refinance: Borrow up to 80% of value (e.g., $400k on $500k home) for renovations

– HELOC priority: Use funds for value-boosting projects first (kitchen/bath), not vacations

Warning: Appraisers verify renovation quality—shoddy work negates value gains.

Competitive Pricing for Sellers

List strategically using this formula:

1. Average 3 online estimates

2. Subtract 3% for “quick sale” buffer

3. Add 5% if inventory is low (<2 months supply)

Example: $600k average estimate → $582k listing price → $615k final sale in seller’s market.

Connect With Verified Professionals Immediately

Stop scrolling through sketchy websites. Access these vetted resources:

Bank of America’s Better Money Habits®

Their “Home Value Assessment” toolkit includes:

– Neighborhood scorecards rating schools/safety

– Renovation ROI calculator for your ZIP code

– Agent interview checklist (10 must-ask questions)

No cost: Free at bettermoneyhabits.bankofamerica.com

Chase City Comparison Reports

See exactly how your market stacks up. Their Tampa vs. Houston analysis reveals:

– Which city’s values grew fastest post-pandemic

– How school districts impact price-per-square-foot

– Timing windows for maximum profit

Access: Search “Chase Home Value City Comparisons”

Final Note: Your home’s value isn’t static—it’s a moving target shaped by market pulses and personal choices. Start with Bank of America or Chase for a baseline number today, then within 48 hours, contact a local agent for a CMA. If refinancing or facing legal decisions, book an appraisal immediately—waiting costs thousands in missed opportunities. Track your value quarterly using county records, and always factor in neighborhood shifts before making major financial moves. Remember: The most accurate answer to how to find value of home blends digital speed with human expertise. Your largest asset deserves nothing less.