Finding the right mortgage lender makes the difference between building wealth through homeownership and struggling under unnecessary debt. Many homebuyers accept the first lender they encounter, potentially costing themselves $30,000 or more over a 30-year loan. Learning how to find a home mortgage lender that aligns with your specific financial situation and goals transforms the home buying process from stressful to strategic.

The mortgage industry has evolved far beyond traditional bank visits. Today’s borrowers can access dozens of lender types—local credit unions, national banks, online platforms, and specialized brokers—each offering different rates, fees, and service experiences. This guide delivers actionable steps to identify lenders matching your credit profile, down payment amount, and service expectations, ensuring you secure the most favorable terms possible.

Check Your Credit Reports Before Contacting Lenders

Dispute Errors at All Three Bureaus Immediately

Pull reports from Equifax, Experian, and TransUnion through AnnualCreditReport.com—errors appear on 25% of reports according to the Federal Trade Commission. Incorrect late payments, closed accounts showing as open, or fraudulent inquiries can drop your score 50+ points. Dispute errors online with each bureau using certified mail for documentation. Most corrections process within 30 days, but urgent disputes can sometimes be resolved in 7-10 business days.

Optimize Credit Utilization Before Rate Shopping

Reduce revolving credit balances below 30% of limits at least six months before applying—this single action can boost scores 20-40 points. Avoid closing old credit cards as this reduces your available credit and increases utilization ratio. Never apply for new credit during the mortgage process as each inquiry can cost you 5-10 points. Your mortgage rate depends heavily on these numbers—just a 0.25% difference on a $300,000 loan saves you $47 monthly.

Apply to Three Lenders Within 14 Days

Compare National Banks, Credit Unions, and Online Lenders

Contact at least one lender from each category to see which offers the best combination of rates and service. National banks like Chase or Bank of America provide consistent nationwide service but may have higher fees. Credit unions often offer lower rates but require membership eligibility. Online lenders like Rocket Mortgage streamline the process but may lack personalized support. Each type serves different borrower needs—your perfect match depends on your priorities.

Time Your Applications Strategically

Complete all lender applications within a 14-day window so credit bureaus count them as a single inquiry, minimizing scoring impact. Create a spreadsheet tracking these critical elements from each lender:

– Interest rate and APR (annual percentage rate)

– Total closing costs breakdown

– Loan origination fee percentage

– Rate lock period and extension costs

– Estimated closing timeline

This comparison reveals which lender offers the best true cost—not just the lowest headline rate. A slightly higher rate with significantly lower fees might save you thousands over the loan term.

Ask These Critical Questions During Lender Interviews

Timeline and Communication Assessment

Ask each lender: “What’s your average closing time from application to funding in our local market?” Follow up with: “What happens if an appraisal comes in low?” Fast closings matter in competitive housing markets where delays can cost you the property. Also determine communication preferences—some lenders provide daily updates while others only contact you when problems arise.

Fee Structure Deep Dive

Request a detailed breakdown of all costs with this question: “Can you show me exactly what’s included in your loan origination fee?” Many lenders charge 0.5-1.5% of the loan amount here. Ask specifically about:

– Discount points (prepaid interest to lower your rate)

– Third-party fees (appraisal, title insurance, credit report)

– Escrow account requirements for taxes and insurance

– Rate lock extension fees if closing takes longer than expected

Lenders must provide a Loan Estimate within three business days—compare these standardized forms side-by-side to see true cost differences.

Research Lender Reputation Beyond Star Ratings

Analyze Verified Customer Reviews Strategically

On Zillow’s Mortgage Marketplace, filter reviews by borrowers with similar credit scores and loan types. Look for patterns in complaints about hidden fees, communication breakdowns, or closing delays. One negative review among dozens isn’t concerning, but multiple complaints about the same issue (like appraisal problems) signal potential red flags. Pay special attention to how lenders respond to negative reviews—professional, solution-oriented responses indicate good customer service.

Verify References with Specific Scenarios

Ask lenders for 2-3 recent clients with similar financial profiles. Contact them directly with these questions:

– “What challenges arose during your process?”

– “How did the lender resolve issues with underwriting or appraisal?”

– “Were there any unexpected fees at closing?”

References provide real-world insights no website can match. They’ll tell you whether the lender delivers what they promise when problems inevitably arise.

Understand Key Lender Types and Their Benefits

Mortgage Bankers vs. Portfolio Lenders

Mortgage bankers (like Quicken Loans) fund loans using borrowed capital then sell them to investors after closing. This model offers competitive rates but less flexibility in underwriting. Portfolio lenders (typically community banks and credit unions) keep loans in their own investment portfolios, allowing more personalized approval decisions. They may consider factors beyond standard credit scoring, benefiting borrowers with unique circumstances like self-employment or recent credit issues.

Hard Money Lenders—When to Consider Them

Private hard money lenders provide short-term financing (6-24 months) at high interest rates (10-15%+) for real estate investors. These loans feature 2-5 point origination fees and focus on property value rather than creditworthiness. Only consider hard money for investment properties you plan to flip or refinance quickly—never for your primary residence where traditional financing offers better terms.

Leverage Zillow Mortgage Marketplace Effectively

Target Local Lenders Serving Your Specific Area

Enter your target property’s zip code on Zillow’s platform to see lenders actively serving that market. Local lenders often have better relationships with regional appraisers and title companies, potentially speeding up your closing. Filter results by loan type (conventional, FHA, VA) and credit score range to see lenders most likely to approve your application.

Maintain Control of Your Information

Your contact details only go to lenders you specifically select—Zillow doesn’t mass-distribute your information. The platform uses banking-level encryption to protect your data, and you control how many lenders contact you. This prevents the flood of sales calls that often follows mortgage inquiries while still allowing meaningful comparison shopping.

Calculate True Loan Costs Beyond the Interest Rate

Analyze Total Costs Over Your Expected Ownership Period

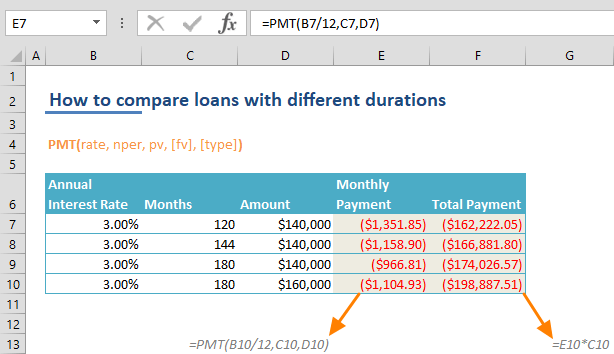

Don’t just compare monthly payments—calculate total costs based on how long you plan to stay in the home. A loan with slightly higher interest but $3,000 lower closing costs might save you money if you sell or refinance within five years. Use this formula:

Total Cost = (Monthly Payment × Months) + Closing Costs

Negotiate Fees Before Finalizing

Many closing costs are negotiable—especially lender fees. Ask: “Which fees can you reduce or waive for me?” Some lenders will waive application fees, administrative charges, or even cover part of your appraisal cost to win your business. Always request a revised Loan Estimate after negotiating to see the actual impact on your bottom line.

Key Takeaway: Mastering how to find a home mortgage lender requires preparation, comparison, and verification. Start with your financial profile, shop at least three lenders within a 14-day window, and verify reputations beyond surface-level reviews. The extra effort spent selecting your lender pays dividends through lower payments, reduced stress, and thousands saved over your loan term.

Next Steps: Begin your lender search 60-90 days before house hunting. Check your credit reports immediately, gather financial documents, and get pre-approved from one lender for baseline comparison. Then expand to two additional lender types—local credit union, national bank, or online lender—and compare their Loan Estimates side-by-side. Track all interactions in a spreadsheet and don’t hesitate to negotiate fees or request rate matches from your preferred lender.