Your roof starts leaking during a storm. The HVAC dies in July. The foundation cracks widen by the day. When critical home repairs hit, most homeowners face a brutal choice: drain emergency savings, live with dangerous conditions, or take on crippling debt. The good news? Smart how to finance home repairs strategies can fund essential fixes while preserving your financial stability.

This guide breaks down every legitimate way to pay for home repairs—from tapping equity at favorable rates to securing government grants you never repay. You’ll learn exactly which option fits your timeline, credit score, and repair type, plus how to avoid the predatory lenders circling desperate homeowners. Stop wondering how to finance home repairs when disaster strikes—build your strategic plan now.

Home Equity Loans for Major Structural Fixes

Best for: Large projects ($15,000+) with predictable costs and homeowners with 20%+ equity

Home equity loans provide lump-sum funding secured by your property at fixed interest rates, making them ideal for major structural repairs like foundation issues or full roof replacements. These loans typically feature repayment terms from 5 to 30 years, with most lenders allowing you to borrow up to 80-85% of your available equity.

Calculate your potential borrowing power with this formula: Home value × 0.8 – Mortgage balance. On a $400,000 home with a $200,000 mortgage, you could access up to $120,000. Closing costs run 2-5% of the loan amount, but interest may be tax-deductible when funds improve your property.

Qualifying Requirements Checklist

- Credit score: Minimum 620 (680+ for best rates)

- Equity: At least 15-20% ownership stake

- Debt-to-income ratio: Below 43% including new payment

- Documentation: Recent pay stubs, tax returns, current mortgage statement

Pro tip: Get pre-approved before emergencies strike. Having financing in place lets you negotiate better contractor pricing and avoid rushed decisions that could cost thousands.

HELOC Flexibility for Phased Repair Projects

Best for: Ongoing repairs or uncertain total costs

HELOCs function as revolving credit lines secured by home equity, offering flexibility perfect for discovering hidden damage during renovations. These products feature variable interest rates tied to prime rates, currently ranging from 3-21% depending on creditworthiness. The draw period typically lasts 5-10 years, during which you access funds as needed.

Unlike lump-sum loans, you only pay interest on amounts drawn. Need $5,000 for electrical work today and $8,000 for plumbing next month? Draw exactly what you need, when required. However, be prepared for potential payment shock when the draw period ends and full repayment begins.

Smart HELOC Strategies

- Reserve discipline: Establish project budgets before accessing funds

- Rate monitoring: Track prime rate changes to anticipate payment adjustments

- Payment planning: Budget for potential rate increases during repayment period

Warning: If prime jumps from 8% to 12%, your $20,000 balance costs an extra $800 annually in interest alone. Always have a contingency plan for rate increases.

Government Programs for Home Repair Funding

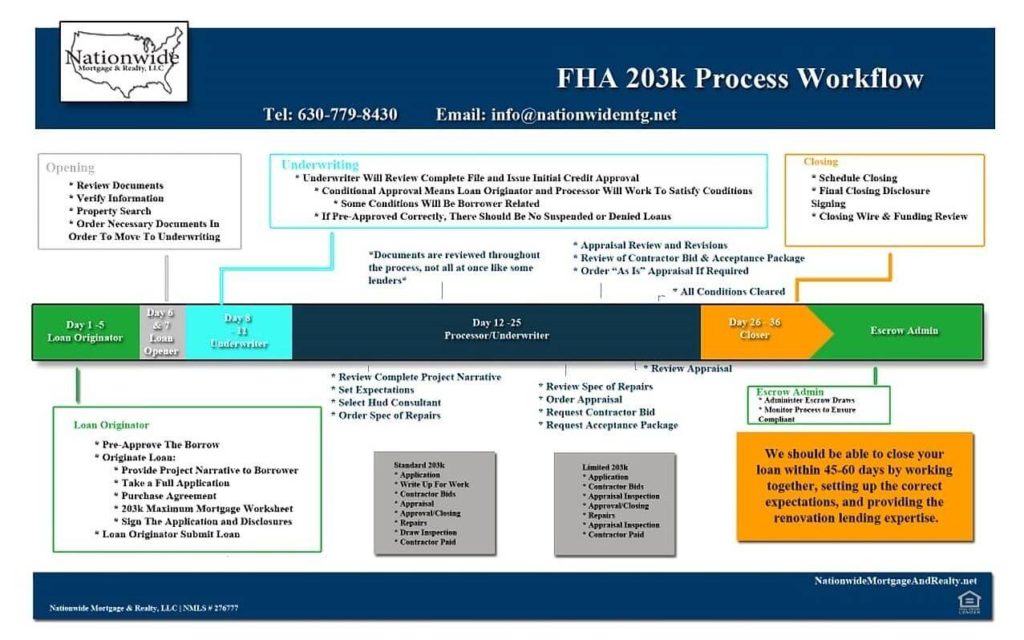

FHA 203(k) Renovation Loans

Combine purchase or refinance with repair costs in one mortgage. The Standard 203(k) covers major structural work over $5,000, while the Limited 203(k) handles smaller projects up to $35,000. Both require FHA-approved contractors and detailed project plans. Eligible improvements include structural alterations, safety hazard elimination, and energy conservation upgrades.

USDA Rural Repair Program

If you live in a rural area and earn below 50% of median income, access loans at just 1% interest plus grants up to $10,000 for seniors 62+. Verify eligibility at eligibility.sc.egov.usda.gov before applying. The Section 504 program provides loans up to $40,000 with 20-year terms for very low-income homeowners in eligible rural zones.

State-Level Repair Assistance

Every state operates unique programs. California offers CalHFA 0% interest deferred loans for seniors, New York provides RESTORE funding up to $20,000 for emergency repairs, and Texas administers the Homeowner Assistance Fund for disaster-related repairs. Action step: Google “[your state] housing finance agency home repair programs” to uncover local options.

Emergency Financing for Immediate Repairs

Credit Cards for Rapid Response

When your basement floods at 2 AM, 0% APR credit cards provide instant access to funds with 12-21 months interest-free periods. Home improvement store cards often extend promotional financing on purchases above $299. However, standard APRs range from 15-29% after promotional periods—use this option only for short-term borrowing.

Personal Loans for Quick Access

Unsecured personal loans deliver $5,000-$100,000 at fixed rates from 6-36% based on credit scores, with funding timelines as fast as 1-3 business days. Online lenders like SoFi or Lightstream offer competitive terms without requiring home equity. No collateral means faster approval but higher rates than secured options.

Contractor Financing Reality Check

Many contractors partner with lenders offering 0% promotions for 6-24 months. Read the fine print—miss one payment and 29.99% APR hits retroactively on the entire balance. Compare these offers against your own financing options before signing any agreement.

Insurance Claims That Cover Emergency Repairs

Standard Homeowners Coverage

Your policy covers sudden damage from fire, storms, or burst pipes—but not wear-and-tear. Document everything: take photos, perform temporary repairs to prevent further damage, and collect contractor estimates. Deductibles typically range $500-$2,500, but multiple small claims can trigger premium hikes or non-renewal.

Flood and Earthquake Protection

Standard policies exclude these perils. Flood insurance (NFIP.gov) requires 30-day waiting periods, so don’t wait until hurricane season. Earthquake coverage features high deductibles (10-25% of coverage limits) but makes sense in high-risk zones. California residents can access coverage through the California Earthquake Authority.

Home Warranty Limitations

These service contracts cover systems and appliances but exclude pre-existing conditions and structural repairs. Use them for HVAC or appliance failures, not foundation cracks or roof leaks. Service call fees range from $75-$125 per incident, with annual premiums between $300-$800.

Avoiding Predatory Repair Financing

Red Flags That Signal Trouble

- High-pressure tactics: “Sign today or lose this rate!”

- Door-to-door contractors: Especially after storms

- Large upfront deposits: Never pay more than 10% before work starts

- Unlicensed contractors: Verify at your state contractor board

The Deferred Interest Trap

That 0% offer becomes 29.99% if you miss one payment—or if the balance isn’t paid in full by month 18. Calculate the worst-case scenario before accepting any financing offer. Legitimate lenders provide time to review offers without pressure.

Decision Framework for Choosing Your Option

Step 1: Assess Repair Urgency

- Critical: Safety hazards, active water damage → Credit card/contractor financing bridge to permanent loan

- Important: Roof replacement, HVAC → Home equity loan/HELOC

- Planned: Kitchen remodel → Savings accumulation or 0% credit card

Step 2: Calculate Your Numbers

Available equity = Home value × 0.8 - Mortgage balance

Example: $400,000 × 0.8 - $200,000 = $120,000 available

Step 3: Compare Total Costs

Include all fees, interest, and potential tax benefits. A 7% HELOC might beat a 5% home equity loan once closing costs are factored in. Always calculate the annual percentage rate (APR) to compare true costs.

Implementation Roadmap for Repair Financing

Before You Need Repairs

- Check your credit: 3-6 months before applications

- Estimate equity: Use Zillow + recent appraisal

- Research local programs: State housing agencies, utility rebates

- Build contractor relationships: Get quotes during off-season

When Emergency Strikes

- Secure the damage: Prevent further harm, document everything

- Check insurance: File claims immediately for covered damage

- Get three estimates: Within 48 hours for urgent repairs

- Activate pre-approved financing: Or apply for fastest option

Post-Funding Management

- Set up automatic payments: Never miss a due date

- Track tax benefits: Save receipts for deductible improvements

- Monitor contractor progress: Release funds based on milestones

- Plan next steps: Build emergency fund for future repairs

Final Strategy: Layering Financing Options

Smart homeowners combine financing strategically. Use a 0% credit card for immediate contractor deposits, process an insurance claim for covered damage, then close a home equity loan for the balance. This maximizes rewards, minimizes interest, and keeps options open.

Remember: The best how to finance home repairs solution is the one you understand completely. Read every document, calculate total costs, and never let urgency override due diligence. Your home—and your financial future—depend on it. Pull your credit report today, research your state’s repair programs, and establish relationships with three licensed contractors. When the next repair emergency hits, you’ll have financing options ready instead of panic decisions.