Picture this: You’ve found the perfect lakeside cabin where your family can escape summer heat, or maybe a mountain condo for winter ski trips. But before you start planning weekends away, you’ll need to navigate the complex world of second home financing. Unlike your primary residence mortgage, second home loans come with stricter requirements, higher rates, and unique qualification hurdles that can catch eager buyers off guard.

Getting approved for a second mortgage isn’t just about having good credit—it’s about proving you can handle two mortgage payments while maintaining reserves for both properties. The good news? With proper preparation and understanding of lender requirements, you can successfully secure financing for your dream getaway property.

This guide breaks down everything you need to know about qualifying, applying, and closing on a second home mortgage in today’s market.

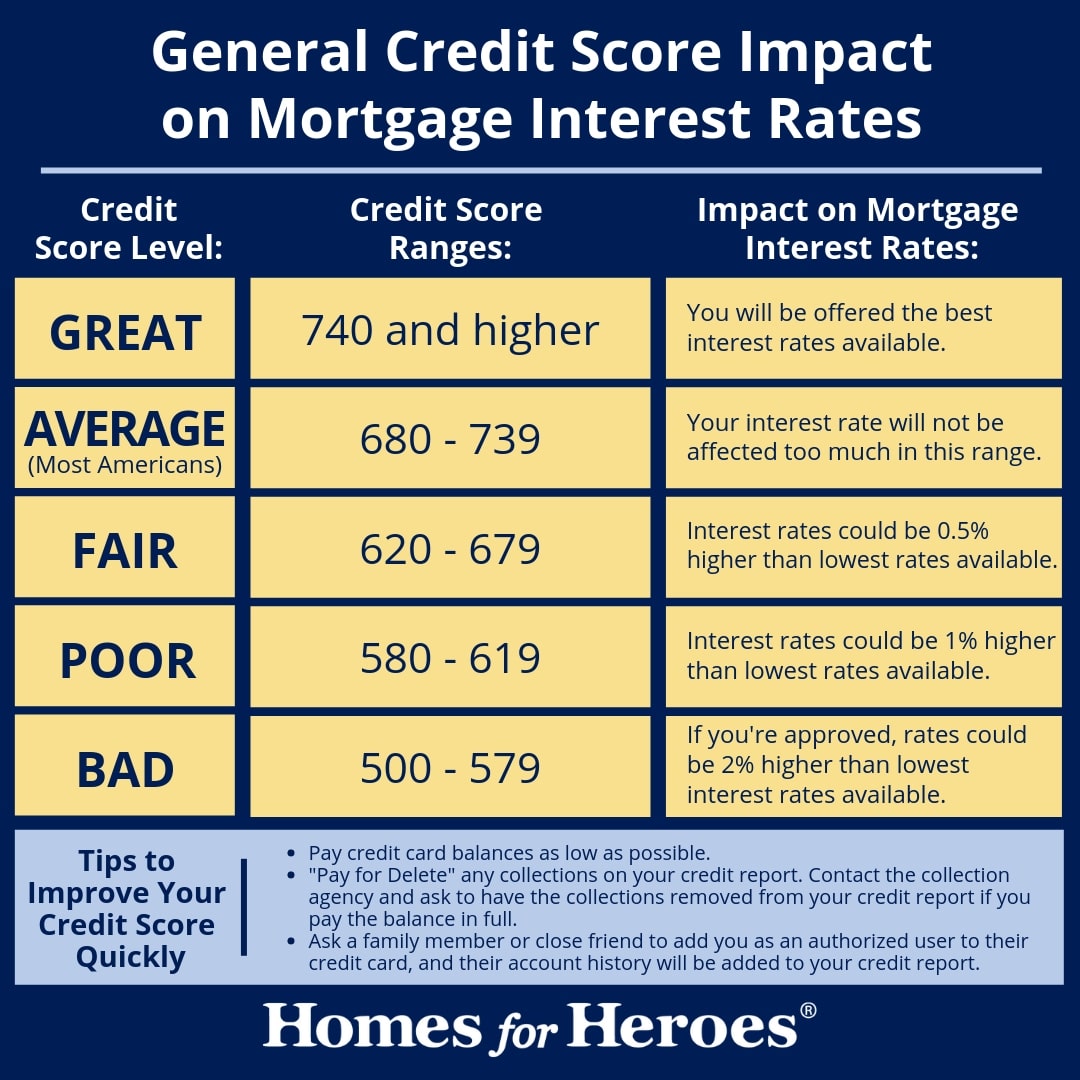

Credit Score Requirements for Second Homes

Your credit score takes center stage when lenders evaluate second home applications. While conventional loans typically require 620-640 as a minimum, you’ll need 740 or higher to unlock the best interest rates. Each 20-point increase can reduce your rate by 0.125-0.25%, potentially saving thousands over the loan term.

Unlike primary mortgages, lenders view second homes as higher risk, making credit scores more critical. A 740+ score demonstrates consistent financial responsibility across multiple obligations. Lenders scrutinize recent credit history more carefully, particularly any new debt inquiries or missed payments.

Pro tip: Start improving your credit 6-12 months before applying. Pay down credit card balances to under 30% utilization, avoid new credit inquiries, and check for any reporting errors that could drag down your score. Consider setting up automatic payments to ensure on-time payments for all accounts.

Debt-to-Income Ratio Limits

Lenders scrutinize your debt-to-income ratio (DTI) more strictly for second homes. While primary residences allow up to 50% DTI, second home mortgages typically cap at 45%. This calculation includes both your current mortgage payment and the new second home payment, plus all other monthly debts.

Calculate Your Maximum Qualifying Payment

- Add all monthly debt payments (credit cards, car loans, primary mortgage)

- Include estimated second home payment (PITI)

- Divide total by gross monthly income

- Ensure result stays below 45%

Quick fix: Pay down high-balance credit cards or consider a larger down payment to reduce monthly obligations. If your DTI is borderline, adding a co-borrower with strong income can significantly improve your qualification odds without requiring additional cash reserves.

Down Payment Strategies

Second home mortgages require significantly more upfront cash than primary residences. Conventional loans demand 10-20% down, with 20% being the standard threshold to avoid private mortgage insurance (PMI).

Down Payment Options by Credit Score

- 740+ credit: 10% down possible with strong DTI

- 680-739 credit: 15-20% down typically required

- 620-679 credit: 20% minimum, some lenders require 25%

Cash reserve requirement: Most lenders want 2-6 months of mortgage payments for both properties in liquid accounts. In 2024’s tighter market, some now require 12 months reserves. These funds must be fully documented and verifiable, not borrowed or gifted for second home purchases.

Property Location Rules

Your dream property must meet specific location criteria to qualify as a second home. Lenders typically require properties to sit 50-100 miles from your primary residence, though vacation destinations often receive exceptions.

Distance Documentation

- Properties within 50 miles: Provide explanation letter detailing unique market features

- Vacation areas: Document seasonal usage plans and market differences

- Urban second homes: Ensure building allows owner occupancy

Red flag alert: Buying a property too close to your primary residence may trigger investment property classification, requiring 20-25% down payment and higher rates. If you plan to rent the property frequently, lenders may also classify it as an investment property regardless of distance.

Loan Types That Work

Conventional loans dominate second home financing, offering both fixed-rate and adjustable options. Government-backed programs have limited availability—VA loans work for eligible veterans with zero down, while FHA loans generally exclude second homes.

Conventional Loan Breakdown

- 30-year fixed: Most popular, stable payments

- 15-year fixed: Lower rates, faster equity building

- 5/1 ARM: Lower initial rate, rate adjusts after 5 years

Portfolio loan option: Some lenders keep these loans in-house, offering flexibility for unique situations but typically at higher rates. For veterans, VA loans remain the most attractive option with no down payment requirement and competitive rates.

Application Documentation Checklist

Prepare for extensive paperwork proving you can handle dual mortgages. Lenders verify every aspect of your finances more thoroughly than primary home loans.

Required Documents

- Income: 2 years W-2s, recent pay stubs, 2 years tax returns

- Assets: 2-3 months bank statements showing reserves

- Debts: Current mortgage statement, all loan statements

- Primary home: Insurance declarations, current mortgage details

- Self-employed: Additional 2 years business returns plus P&L statement

Pro move: Organize everything digitally before starting pre-approval to avoid delays. Missing documentation is the #1 cause of second home mortgage application delays—have backup copies of everything.

Rate Premiums and Additional Costs

Second home mortgages carry pricing adjustments that increase your interest rate 0.125-0.375% above primary residence rates. Your exact premium depends on credit score, loan-to-value ratio, and market conditions.

Second Home Cost Breakdown

- Rate premium: 0.125-0.375% above primary residence

- Origination fees: 0.5-1% of loan amount

- Appraisal: $500-1,000+ depending on property

- Title insurance: Required for all purchases

- Reserves: 2-12 months PITI depending on lender

2024 reality check: Second home rates currently average 7-8%, reducing purchasing power by 10-15% compared to 2021 levels. Factor these higher carrying costs into your affordability calculations before falling in love with a property.

Tax Implications You Must Know

Mortgage interest on second homes remains deductible, but new limits apply. You can only deduct interest on up to $750,000 of combined mortgage debt between both properties.

Tax Deduction Quick Facts

- Interest limit: $750,000 combined mortgage debt

- SALT cap: $10,000 maximum for state/local taxes including property taxes

- 14-day rule: Rent less than 15 days annually = no rental income reporting

Planning tip: Consult a tax advisor before purchase to understand your specific deduction potential and quarterly payment adjustments. Proper tax planning can save thousands annually, but missteps can trigger audits or unexpected tax bills.

Overcoming Common Approval Obstacles

High debt-to-income ratios top the list of second home denials. Lenders see two mortgage payments as risky, especially with rising rates.

Quick Solutions for High DTI

- Pay down debt: Target credit cards with high minimum payments

- Add co-borrower: Include spouse or family member with income

- Increase down payment: Reduces monthly payment and LTV ratio

- Portfolio lender: May allow higher DTI with compensating factors

Emergency strategy: Consider a HELOC on your primary residence to increase down payment and reduce second home loan amount. This approach lowers your DTI while accessing equity you’ve already built.

Alternative Financing Routes

When traditional second home mortgages don’t work, creative financing options exist. These strategies often come with trade-offs but can make your purchase possible.

Home Equity Options

- HELOC: Lower rates than second mortgage, but risks primary home

- Cash-out refinance: Access primary residence equity for down payment

- Bridge loan: Short-term financing for timing gaps

Investment property pivot: Purchase as rental property with 20-25% down, then convert to personal use. Rates run 0.5-0.75% higher but qualification may be easier if you have strong rental income potential.

Market-Specific Considerations (2024-2025)

Today’s market presents unique challenges. Lenders have tightened requirements significantly, with many now capping loan-to-value at 80% and requiring 12 months reserves.

Current Market Realities

- Reduced demand: Second home purchases down 30-40% from 2021 peaks

- Stricter guidelines: Many lenders avoiding high-risk vacation markets

- Rate environment: 7-8% rates becoming standard

Strategy adjustment: Consider waiting for rate stabilization if not urgent, or explore portfolio lenders who maintain more flexible criteria. Be prepared for more extensive underwriting and documentation requirements than in previous years.

Final Success Checklist

Before starting your second home journey, ensure you’ve covered these critical steps:

- Credit score: 740+ for best rates, minimum 620-640

- Cash reserves: 2-12 months both properties (trending toward 12)

- Down payment: 20% standard, 10% possible with excellent credit

- DTI ratio: Below 45%, ideally below 36%

- Professional team: Experienced second home lender and local agent

- Exit strategy: Plan for property disposition if circumstances change

Bottom line: Second home mortgages demand more preparation than primary residence loans, but with proper planning and realistic expectations, financing your dream getaway remains achievable. Start building your credit profile and cash reserves now, and you’ll be ready when the perfect property appears.