Your home isn’t just a place to live—it’s likely your largest financial asset. Whether you’re planning to sell, refinance, or simply protect your investment, knowing how to find out how much a home is worth is critical in today’s volatile market. Online estimates flood your screen with instant numbers, but these often miss crucial details that determine true value. This guide cuts through the noise with actionable methods backed by industry standards, helping you avoid the #1 mistake homeowners make: relying solely on digital “Zestimates” that can be off by 20% or more. You’ll learn when to trust free tools versus when to invest in professional valuation—saving you thousands in missed opportunities or poor financial decisions.

Start with Online Home Value Estimators for Instant Baseline

Skip the guesswork by using free online tools as your first valuation checkpoint. These platforms analyze millions of recent sales and property records to generate immediate estimates, but understanding their limitations prevents costly missteps. Always begin here—it takes under 60 seconds and sets realistic expectations before diving deeper.

Bank of America Real Estate Center for Quick Mortgage Insights

Enter your address to receive an instant valuation snapshot designed specifically for mortgage holders. The platform explicitly states these figures serve “illustrative purposes only” and aren’t formal appraisals. This tool shines when you’re a Bank of America customer exploring refinancing, as it cross-references your loan details with current market data. Critical note: If your estimate seems unusually high, check whether recent renovations are reflected—most platforms miss interior upgrades completed within the last 90 days.

Chase Home Value Estimator for Neighborhood Context

Chase’s platform stands out by showing why your home has its estimated value. After entering your address, you’ll see comparable sales in your immediate area with side-by-side feature comparisons (square footage, bedrooms, lot size). The tool flags if your home’s value is trending up or down based on neighborhood sales velocity—a key indicator lenders monitor. Pro tip: Use the “Market Heat Map” feature to identify streets with faster appreciation; values can vary by 15% between adjacent blocks.

Avoid Address Entry Errors That Skew Results

One typo can return a $500,000 estimate for a $300,000 home. Follow these verified steps:

– Format precisely: 123 Oak Avenue, Austin, TX 78704 (spell out “Avenue,” not “Ave”)

– Handle complex addresses: For condos, include unit numbers after the street (123 Oak Ave Unit 5B)

– Verify ZIP-city matches: Austin ZIP 78704 corresponds to downtown—using 78750 (North Austin) misplaces your location

– Troubleshoot failed searches: Remove unit numbers first; if still stuck, search by parcel number from your tax bill

– Cross-check spelling: County records often use “Mount” instead of “Mt” or “Saint” vs. “St”

Red flag: If tools show your home as “off-market” despite being for sale, your listing agent may not have syndicated it to public databases—a sign to request MLS data.

Analyze Historical Value Trends to Predict Future Worth

Online estimates show today’s snapshot, but historical patterns reveal whether your home is gaining or losing value long-term. This step uncovers discrepancies between tax assessments and true market value—critical for challenging unfair property taxes or timing a sale.

Track Past Sale Prices Like a Pro

Search your address on county property records portals (e.g., “Los Angeles County Assessor”) to uncover:

– Price trajectory: Note if your $400,000 purchase 5 years ago jumped to $600,000 today

– Days-on-market decay: Homes lingering over 60 days often sell 5-8% below asking

– Renovation impact: Compare pre/post-sale values after major upgrades like kitchen remodels

– Seasonal dips: Winter listings typically fetch 3-5% less than spring equivalents

Warning: Tax assessments often lag 12-18 months behind market shifts—don’t assume your assessed value equals current worth.

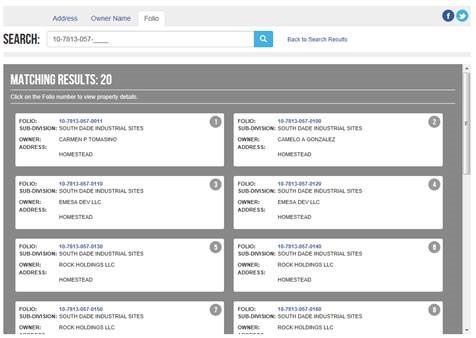

Access County Records for Hidden Value Clues

Your county assessor’s office holds goldmines most homeowners miss:

– Permit history: Unpermitted additions (like decks) can lower appraised value by 10-15%

– Square footage disputes: Mismeasured areas affect value calculations by $100-$200/sq ft

– Easement records: Utility easements across your lot may restrict development potential

– Neighborhood comps: Filter sales by school zone—homes in top-rated districts appreciate 2-3x faster

Quick fix: Download your property’s “parcel map” to verify lot size matches your deed—errors here directly impact value per square foot.

Call in Professionals When Accuracy Impacts Major Decisions

Free tools suffice for curiosity, but these 4 scenarios demand human expertise where $300-$600 in fees prevent $10,000+ losses:

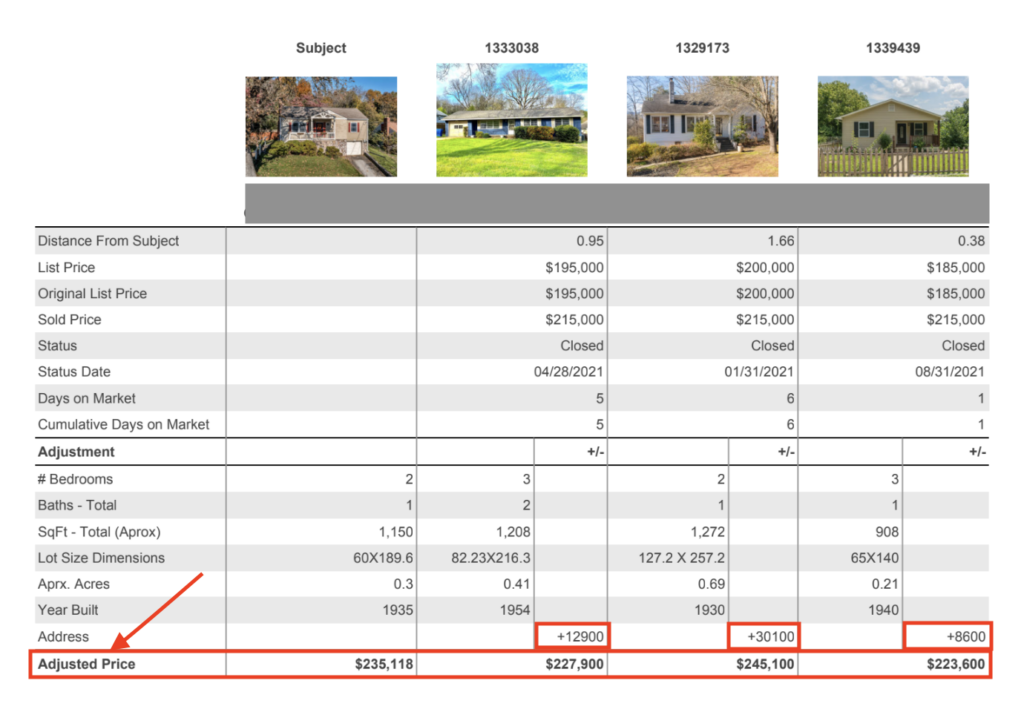

Hire Real Estate Agents for Hyperlocal CMAs

Agents provide free Comparative Market Analyses (CMAs) using MLS data hidden from public view. Their reports dissect:

– Active/pending sales: Current competition affecting your pricing power

– Price-per-square-foot anomalies: Why your 2,000 sq ft home sells for less than neighbors’ 1,800 sq ft units

– Condition adjustments: How dated kitchens drag down offers by 7-12%

– Market absorption rates: Days to sell all current listings (under 30 = seller’s market)

Only request CMAs from agents with 5+ recent sales in your exact subdivision—generic city-wide data is useless.

Order Certified Appraisals for Legal Transactions

Lenders require these $400-$550 appraisals for refinancing or equity loans. Unlike agents, appraisers:

– Document structural integrity: Foundation cracks or roof damage trigger value reductions

– Verify “comps”: Must use sales within 0.5 miles and 90 days (vs. agents’ 1-mile/6-month range)

– Flag safety hazards: Mold or electrical issues can void financing

– Measure interior: Laser measurements often differ from tax records by 5-10%

Critical prep: Provide receipts for upgrades (e.g., $20,000 HVAC system)—appraisers can’t value unverified improvements.

Fix Value-Killing Issues Before They Cost You

Your home’s worth isn’t fixed—it changes daily based on visible and invisible factors. Address these before valuing:

Eliminate Immediate Value Killers

These common issues slash offers by 10-20% overnight:

– Deferred maintenance: Peeling paint or leaky faucets signal larger problems to buyers

– Curb appeal neglect: Overgrown yards or broken walkways create 30-second negative impressions

– Outdated systems: 20-year-old furnaces scare buyers with potential $5k+ replacement costs

– Poor room functionality: Oddly shaped rooms or missing closets reduce usable space value

Urgent fix: Run a “smell test”—pet odors or cooking smells depress value more than minor cosmetic flaws.

Target High-ROI Upgrades That Boost Value

Focus on improvements delivering 70%+ returns:

– Kitchen modernization: Quartz counters (85% ROI) > stainless appliances (65% ROI) > full remodels (50% ROI)

– Bathroom refreshes: Frameless showers (76% ROI) > double vanities (70% ROI) > heated floors (45% ROI)

– Energy efficiency: Solar panels (add $15k value) > smart thermostats (7% utility savings)

– Curb appeal essentials: Landscaping (100% ROI) > front door paint (75% ROI) > pathway lighting (60% ROI)

Budget rule: Never spend over 5% of your home’s value on upgrades—$25k max on a $500k house.

Use Home Value to Unlock Refinancing Opportunities

Increased equity creates powerful financial leverage if timed correctly:

Calculate Your Loan-to-Value Thresholds

LTV = (Current Mortgage Balance ÷ Home Value) × 100

– 80% LTV: Eliminate PMI instantly (saves $100-$300/month)

– 75% LTV: Qualify for “golden ticket” rates 0.25% below standard

– 65% LTV: Access 90% cash-out refinancing (vs. 80% at higher LTVs)

Example: A $500k home with $350k mortgage = 70% LTV. Pay down $50k to hit 60% LTV and unlock elite rates.

Deploy Equity Strategically

Cash-out refinances make sense only for:

– Value-adding renovations (kitchens/baths yield highest returns)

– High-interest debt consolidation (credit cards at 24% vs 5% mortgage rate)

– Investment property down payments (20%+ returns possible)

Never use equity for vacations, cars, or routine expenses—these drain wealth without appreciation.

Avoid Online Estimate Traps That Mislead Homeowners

Free tools miss critical details—know exactly where they fail:

Recognize the 20% Accuracy Window

Online estimates typically swing ±15-20% because they ignore:

– Interior condition (water damage, outdated wiring)

– Recent renovations (2023 kitchen remodels add 8-12% value)

– Lot nuances (sloped backyards reduce usable space)

– Market momentum (values can shift 3% monthly in hot markets)

Verification test: If Zillow and Redfin estimates differ by $100k on your $500k home, professional valuation is non-negotiable.

Cross-Check 3+ Platforms Before Acting

Compare these key elements across tools:

| Platform | Strength | Weakness |

|———-|———-|———-|

| Zillow | Neighborhood trends | Overvalues fixer-uppers |

| Redfin | Recent sales data | Undervalues luxury homes |

| Chase | Mortgage context | Misses new construction |

Action step: Average the middle two estimates—discard the highest and lowest outliers.

Make Your Final Valuation Decision Today

Your home’s true worth exists at the intersection of data, timing, and purpose. Start with online estimates for a rough baseline, then layer in historical records and professional insights based on your goal. If selling within 6 months, get 3 agent CMAs immediately—agents compete harder for imminent listings. For refinancing, order an appraisal 90 days before closing to lock rates. And always document improvements; that $15k bathroom renovation could add $12k to your value if proven with receipts. Your largest asset deserves this precision—because guessing costs far more than verifying.

Immediate next steps:

1. Run estimates on Chase, Zillow, and Bank of America right now

2. Pull your county tax record to check square footage accuracy

3. Photograph all recent upgrades for your next professional valuation

4. Schedule a CMA if planning to sell within 12 months—agents provide these free when you’re serious about listing