Finding a reliable home contractor can feel like navigating a minefield when you need urgent repairs after a storm or are planning a major kitchen renovation. One poor choice could drain your savings and leave your home with shoddy work that depreciates its value. The reality is that 72% of homeowners report regretting their contractor selection within the first six months of project completion. But you don’t have to become another statistic—by following these verified steps, you’ll identify qualified professionals who deliver exceptional results while protecting your investment.

This isn’t just another generic contractor checklist. You’ll discover exactly what questions to ask during interviews, how to decode confusing insurance authorization forms, and the specific license formats that separate legitimate contractors from risky operators. Most importantly, you’ll learn the three critical verification steps that prevent 95% of contractor-related disasters before you sign anything.

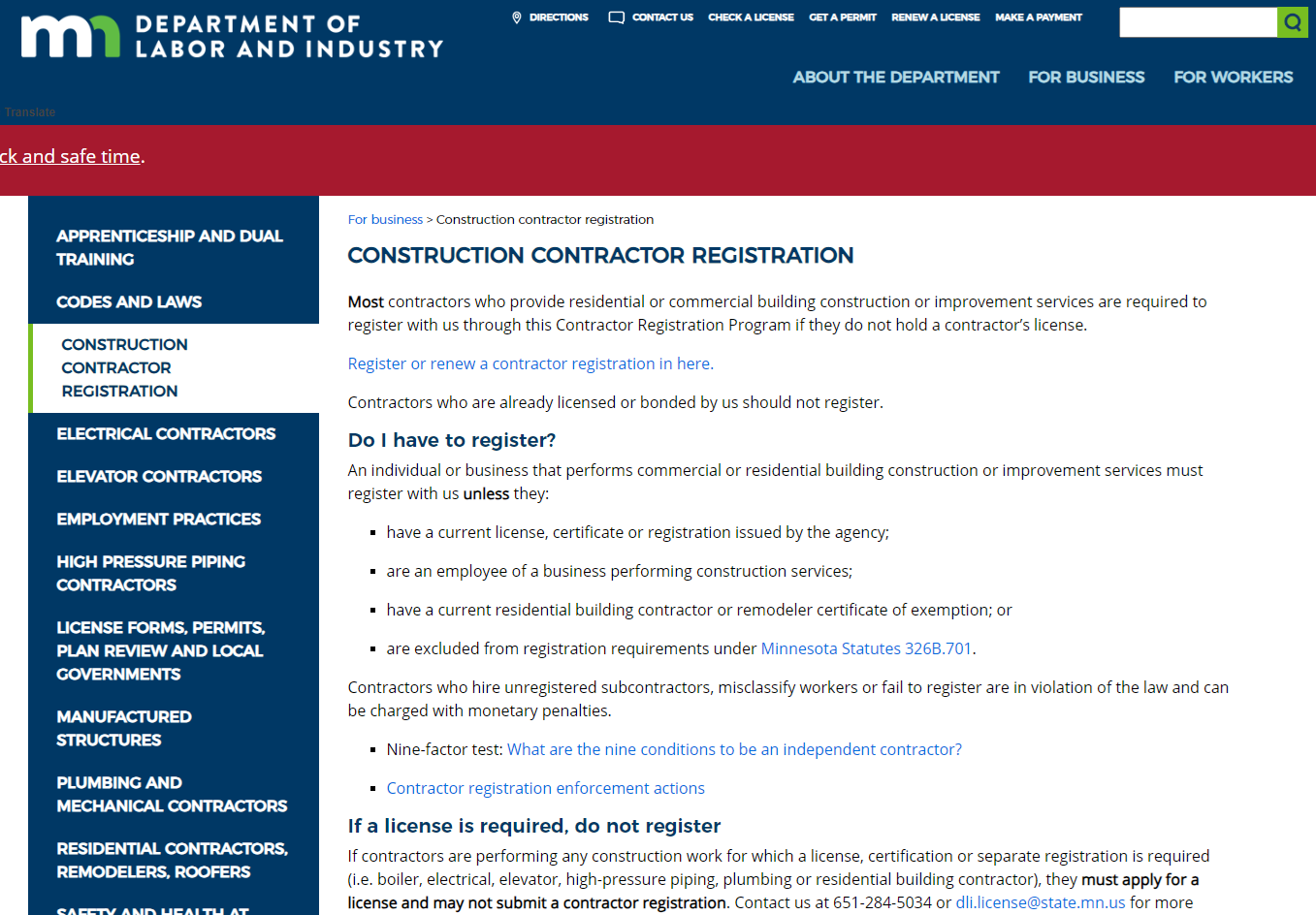

Confirm Active Contractor Licensing Before Any Discussion

Check Real-Time License Status with State Authorities

Never accept a contractor’s word about their licensing status—verify it yourself through your state’s official channels. In Minnesota, call 651-284-5069 or 800-342-5354 during business hours for instant verification. For 24/7 access, use your state licensing board’s online search tool to check both current status and disciplinary history.

Pay attention to license prefixes: Building contractors use “BC” numbers, remodelers have “CR” designations, and roofers display “RR” identifiers. If you encounter “IR” registration numbers instead of proper licensing, walk away immediately—these operators lack required insurance, bonding, and access to consumer protection funds.

Validate Comprehensive Insurance Coverage

Licensed contractors must carry both general liability and property damage insurance, with policies active through your project’s completion. Don’t accept copies from the contractor—request certificates directly from their insurance provider. Verify coverage amounts meet your project’s requirements, especially for major renovations where $1 million minimum coverage is typically necessary.

Critical mistake to avoid: Many homeowners skip re-verifying insurance status right before work begins. Request updated certificates within 48 hours of your project start date—coverage lapses happen more often than you think.

Access Exclusive Consumer Protections

Choosing a licensed contractor unlocks vital protections unavailable with unlicensed operators:

• Contractor Recovery Fund: Financial compensation for defective work, non-performance, or fraud

• Mandatory Continuing Education: Annual training ensures contractors know current building codes

• Verified Insurance Coverage: State authorities confirm valid policies before issuing licenses

These safeguards alone make licensing verification the most important step in how to find a home contractor who won’t leave you financially exposed.

Conduct Deep Background Research Before Signing

Execute Complete Pre-Hiring Due Diligence

Before discussing project details, investigate every contractor candidate through multiple channels:

- State licensing board: Check for complaints, violations, or license suspensions

- Better Business Bureau: Review complaint history and resolution rates

- Court records: Search for lawsuits against the company or owners

- Recent references: Contact homeowners from similar projects completed within the past year

Pro tip: Call references at different times of day—morning calls often yield more candid feedback than afternoon conversations when contractors might be monitoring.

Spot Dangerous Red Flags Immediately

Stop the process if you encounter these warning signs:

- Contractors who “can’t recall” their license number

- Pressure tactics like “limited-time discounts” or “only one crew available”

- Offers to pay your insurance deductible (illegal in all 50 states)

- “Authorization forms” presented as non-binding documents

Never sign any paper without reading every word. Salespeople frequently disguise binding contracts as simple “insurance authorization” forms—your signature creates legal obligations regardless of verbal assurances.

Decode Insurance Contract Traps for Storm Repairs

Understand Deductible Payment Prohibition

State law strictly prohibits contractors from paying insurance deductibles or offering incentives for storm repair work. Any contractor claiming they’ll “work with your insurance” to eliminate your deductible is violating regulations. These illegal practices often lead to inflated claims that can result in your insurance cancellation.

Report immediately: Contact your state licensing board when contractors make these offers—they’re protecting the entire industry from bad actors.

Avoid Authorization Form Scams

Contractors may present documents labeled as:

– Insurance contact authorization

– Damage inspection requests

– Claim assistance forms

These are legally binding contracts that:

– Obligate you to use their services for all insurance-covered repairs

– Include 15-50% cancellation penalties hidden in fine print

– Often transfer claim rights to the contractor

Real-world consequence: Homeowners who sign these without reading have lost thousands when attempting to switch contractors after discovering poor workmanship.

Exercise Your Three-Day Cancellation Right

For unsolicited contractor contact or insurance-related roof repairs, you have three business days to cancel contracts without penalty. This right must appear clearly in your contract—if it’s missing, the contractor violates state requirements. Keep your signed cancellation notice via certified mail with return receipt.

Build Bulletproof Contracts That Protect You

Demand These Six Contract Essentials

Every legitimate home improvement contract must include:

- Detailed scope: Specific work descriptions and exact materials (brands, models, colors)

- Clear timeline: Start date, completion date, and milestone markers

- Itemized cost breakdown: Labor, materials, permits, and fees separated

- Staged payment schedule: Payments tied to verifiable completion milestones

- Specific warranty terms: Duration, coverage limits, and claim process

- Cancellation notice: Three-day right clearly stated when applicable

Critical review step: Compare multiple bids using identical scope descriptions—discrepancies often reveal contractors cutting corners.

Contract Review Protocol Before Signing

Follow this verification checklist:

- Read completely: Never rely on verbal explanations

- Verify scope: Ensure written details match your discussions exactly

- Confirm timeline: Assess realistic completion dates based on project size

- Understand payments: Know when each payment becomes due and what triggers it

- Clarify changes: Establish written process for project modifications

Warning: Never pay more than 10% down or $1,000 (whichever is less) before work begins—this protects you if the contractor disappears.

Verify Financial Stability Through Direct Checks

https://www.licensing.gov.hk/eng/contractor/verify_contractor.html

Confirm Business Legitimacy Through Physical Verification

Ensure contractors operate legitimate, stable businesses by:

- Visiting their office: Verify a professional physical location (not just a PO box)

- Checking business longevity: Prefer companies with 5+ years operating history

- Requesting banking references: Verify financial stability through business banking relationships

- Contacting suppliers: Confirm account standing with major material providers

Pro tip: Ask to see recently completed projects similar to yours—reputable contractors welcome site visits.

Evaluate Professional Standards Through Direct Verification

Request and confirm:

- Recent references: Contact at least three homeowners from similar projects completed last year

- Portfolio review: Examine work quality through multiple completed project photos

- Manufacturer certifications: Confirm training for specific products being installed

- Professional memberships: Check affiliations with NAHB, NARI, or local trade associations

Resolve Disputes Through Proper Channels

Utilize Mandatory Warranty Dispute Resolution

Before pursuing legal action, use your state’s home warranty dispute resolution program. This required first step provides:

- Neutral evaluation of your warranty complaint

- Structured mediation to encourage fair settlement

- Cost containment through formal procedures

- Documentation trail for potential legal proceedings

Key insight: Most disputes resolve at this stage when both parties present evidence to an impartial evaluator.

Access Free Consumer Protection Resources

Download the Consumer’s Guide to Hiring a Residential Building Contractor from your state licensing authority. This essential resource covers:

- Contractor selection criteria with specific questions to ask

- Bid evaluation techniques to compare apples-to-apples

- Contract development best practices

- Mechanic’s lien prevention strategies

- Step-by-step complaint filing procedures

Final Verification Checklist Before Work Starts

Complete These Critical Pre-Work Steps

- Re-verify license status: Confirm active standing within 48 hours of project start

- Confirm insurance validity: Ensure policies remain active and adequate

- Verify permit acquisition: Confirm contractor pulls required permits

- Secure payment protection: Never exceed 10% down payment threshold

Monitor Project Execution Effectively

- Document progress: Take dated photos at each milestone

- Track timeline: Compare actual progress against contracted schedule

- Verify materials: Confirm specified products arrive before installation

- Maintain records: Keep all receipts, communications, and change orders organized

Finding the right contractor requires diligence, but these steps transform an overwhelming process into a systematic verification protocol. Start with license validation, conduct thorough background research, and never sign contracts without complete understanding. Your careful selection process prevents costly mistakes and ensures quality results that enhance your home’s value—making how to find a home contractor a skill that pays dividends for years to come. When in doubt, contact your state licensing authority—they exist to protect you from exactly the pitfalls outlined here.