Moving to a retirement home isn’t just about finding shelter—it’s choosing your daily happiness, health safety net, and social future for decades. Whether planning for yourself or a parent, 78% of families regret rushing this decision when unmet needs arise later. You deserve a place where morning coffee chats spark joy, medical support feels seamless, and your grandkids visit without hesitation. This guide cuts through glossy brochures to reveal exactly what to evaluate, ask, and avoid. Let’s build your personalized roadmap to the right community from day one.

Pinpoint Your Exact Care Requirements Today

Before touring facilities, map your current needs and anticipate future changes. This prevents costly moves when health shifts.

Medical & Mobility Reality Check

Track your ability to handle daily tasks: List all medications, fall incidents, and mobility aids like walkers. Note if cooking meals or managing finances causes stress. If memory lapses occur—like forgetting stove burners are on—prioritize communities with secure memory wings. Documenting these details now reveals whether independent living suffices or assisted care is essential.

Lifestyle Non-Negotiables

Your ideal community must fuel your passions. Need space for pottery wheels or birdwatching? Require weekly synagogue services? Demand proximity to grandkids’ soccer games? Record these must-haves. Pet owners should verify weight limits, vaccination rules, and on-site dog parks. Pro tip: Sketch a 10-year “needs evolution” timeline. If dementia runs in your family, choose a campus with integrated memory care—avoiding traumatic later relocations.

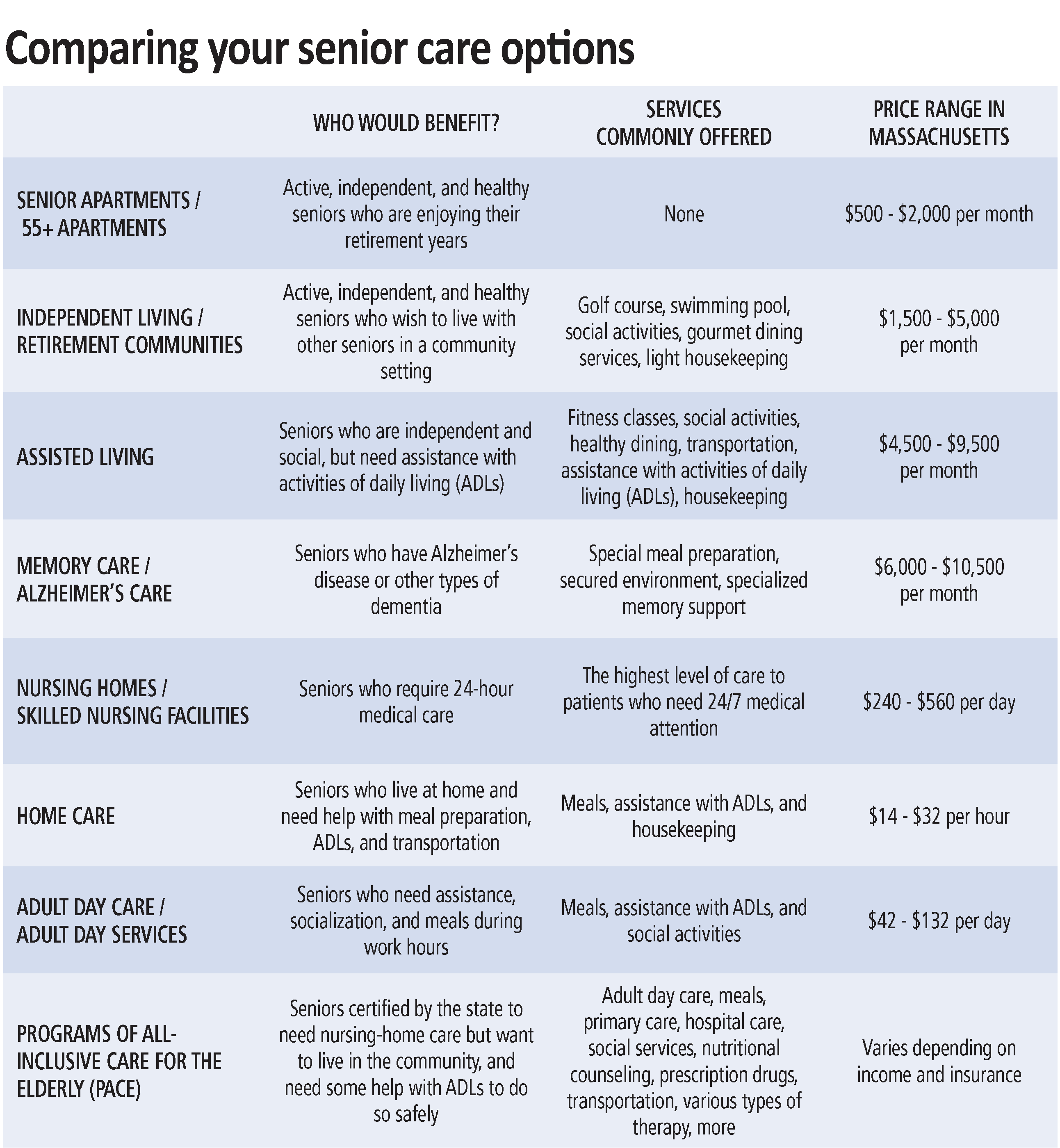

Match Your Needs to Retirement Home Types

Not all communities offer the same care flexibility. Choosing wrong means packing boxes again within years.

Independent Living vs. Assisted Care Reality

Healthy seniors thrive in active 55+ communities with pools and clubs—but need 24/7 medical help? These lack on-site nurses. Assisted living provides bathing support and medication management, yet only CCRCs (Continuing Care Retirement Communities) guarantee lifetime care on one campus. Memory care units feature secured courtyards and dementia-trained staff, while skilled nursing facilities handle complex medical needs. Critical insight: Select the lowest care level fitting your current needs—but confirm higher tiers exist onsite. 92% of families using CCRCs avoid disruptive second moves.

Calculate Your True Retirement Home Budget

Monthly fees often hide costs that drain savings. Avoid sticker shock with this breakdown.

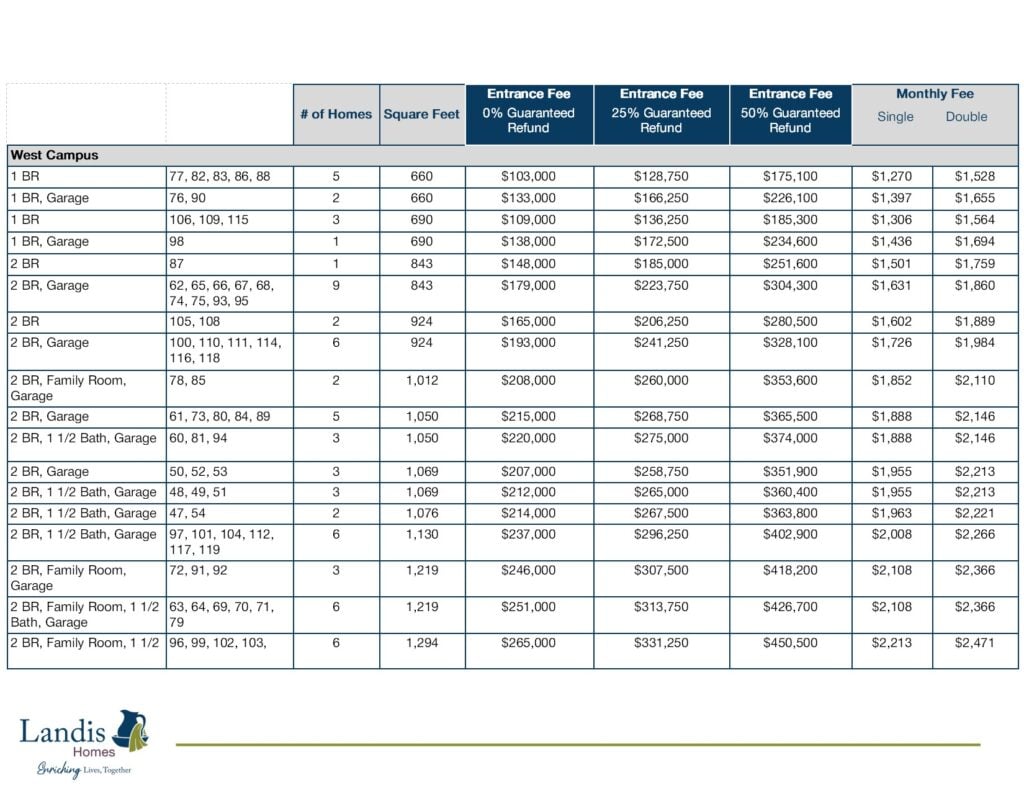

Entrance Fees & Monthly Realities

CCRCs demand $100k–$1M buy-ins (partially refundable), while independent living rentals start at $2,000/month. Assisted living adds $1,000–$2,500 monthly; memory care another $1,000+. Never skip this math: Total costs must stay under 80% of guaranteed income (Social Security + pensions). Factor in hidden fees: pet rent ($50/month), guest meals ($15), salon visits, and annual increases (typically 3–7%). Request 10 years of historical fee hikes—communities with erratic jumps signal financial instability.

Apply the 30-Minute Location Rule Immediately

Proximity impacts daily life more than fancy amenities.

Emergency & Family Access

Choose communities under 30 minutes from:

– Hospitals (critical for sudden health crises)

– Adult children’s homes (spontaneous grandkid visits)

– Airports (out-of-town family access)

Use Google Street View to check traffic patterns and winter road conditions. Climate matters too—extreme heat or icy sidewalks increase fall risks. Coastal areas may offer tranquility but lack specialized medical providers.

Research Like a Pro Before Stepping Foot Inside

Half of families skip remote vetting, landing in facilities with hidden violations.

Verify Safety & Financial Health

Check state licensing portals for recent violations—especially medication errors or fall incidents. For CCRCs, demand Fitch/Moody’s credit ratings and occupancy rates (below 90% = red flag). Scan Medicare.gov for skilled nursing wing ratings. Avoid this mistake: Ignoring Yelp reviews. Filter for verified resident comments mentioning “staff shortages” or “hidden fees”—but disregard one-star rants without specifics.

Conduct Two Strategic Facility Visits

First impressions lie. Unannounced drop-ins reveal operational truths glossy tours hide.

First Visit: The 30-Minute Smell Test

Drop by unannounced at lunchtime. Watch for:

– Lingering urine or chemical odors (indicates poor cleaning)

– Staff-to-resident ratios (count visible caregivers vs. residents)

– Response time to call buttons (over 5 minutes in assisted living = danger)

– Chained emergency exits or expired fire extinguishers

Second Visit: The Deep-Dive Checklist

Bring this list for a 2–3 hour inspection:

– Taste-test meals: Note bland portions or lukewarm temperatures

– Check real units: Demand to see occupied rooms (not just models)

– Verify staff training: Ask about dementia-certified hours

– Test emergency pendants: See response speed firsthand

– Observe resident joy: Are people laughing in common areas?

Ask These Exact Questions by Care Level

Generic queries get scripted answers. Target these instead.

For Assisted Living/Memory Care

- “What’s your staff-to-resident ratio tonight?” (Day ratios often hide nighttime shortages)

- “Show me your last 3 state inspection reports—where were violations?”

- “How do you handle wandering at 2 a.m.?” (Secured courtyards beat sedation)

For CCRCs (Life-Plan Communities)

- “Is your contract Type A (life-care) or Type C (fee-for-service)?”

- “What’s the entrance fee refund timeline if my spouse dies?”

- “How many assisted living beds exist per 100 independent units?” (Under 15 = future waitlists)

Spot Dangerous Red Flags in Under 5 Minutes

Trust these instant warning signs:

– Help-wanted ads plastered in lobbies (staff turnover >50% = instability)

– Residents sitting sedated in common areas (overmedication risk)

– Model-only tours (refusal to show real rooms)

– Restrictive visitor policies (limiting grandkid sleepovers)

Walk away if you smell ammonia or see unexplained bruises on residents.

Contract Review: Non-Negotiable Professional Help

CCRC contracts span 50+ pages with traps. Never sign without:

– An elder-law attorney ($300–$500) to spot Medicaid conversion clauses

– A geriatric care manager to negotiate care-level pricing

– Key focus areas: Entrance fee refunds, special assessment triggers, and care-escalation costs

One couple saved $187,000 by spotting a “declining balance” refund clause that erased 90% of their deposit after 3 years.

Execute a Stress-Free Move-In Transition

Chaotic moves trigger resident depression. Plan these steps:

– Downsize 3 months early: Use estate sale services for furniture

– Change addresses 2 weeks pre-move: Update pharmacies and voter registration

– Pair medical-alert pendants during orientation

– Schedule “welcome lunches” with neighbors to build instant connections

Monitor Your Choice for the First 90 Days

Your work isn’t done at move-in. Track:

– Medication accuracy (check pill organizers weekly)

– Social integration (are you joining 2+ activities weekly?)

– Fee transparency (audit first bill against contract terms)

Contact your state ombudsman immediately for unresolved issues—never suffer in silence.

Final Decision Checklist

Before signing:

– [ ] Completed 10-year “needs evolution” timeline

– [ ] Budget stress-tested with financial advisor

– [ ] Three communities visited twice (once unannounced)

– [ ] Contracts reviewed by elder-law specialist

– [ ] Red flags addressed or dealbreakers identified

Choosing how to select a retirement home defines your golden years. Trust your gut—if staff avoid eye contact or residents seem isolated, keep looking. The right community should feel like a lifestyle upgrade today and a safety net for tomorrow. When you find it, you’ll know by the laughter in the hallways and the peace in your heart.